Malpractice insurance is a crucial aspect of a medical professional’s career, designed to protect against liability arising from patient care. This insurance is not just a safety net; it’s a mandatory aspect of practicing medicine in many jurisdictions.

It covers legal costs and settlements that may arise from allegations of negligence or harm. For healthcare providers, this insurance is a fundamental component of their professional practice, ensuring financial and career protection in the face of unforeseen medical incidents.

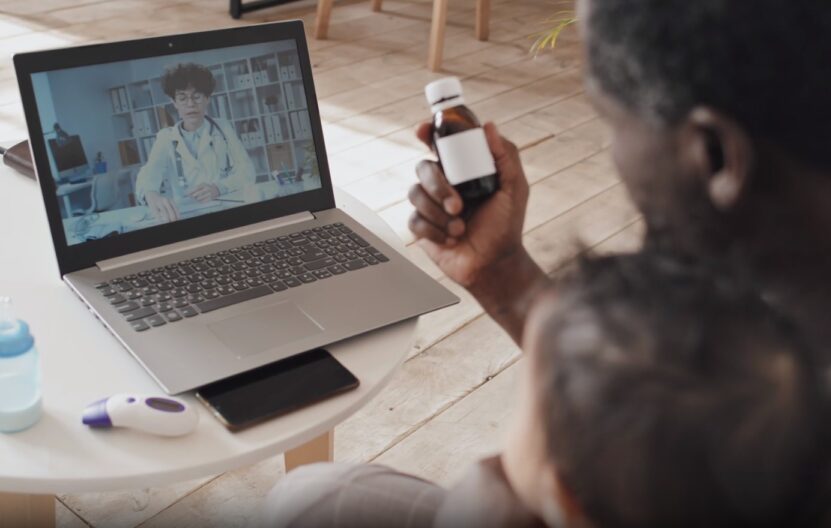

As healthcare delivery evolves, so does the landscape of associated risks and liability coverage needs. The integration of telemedicine into regular medical practice has prompted a reevaluation of traditional malpractice policies. This new mode of healthcare delivery, while innovative and efficient, introduces unique challenges and potential risks.

Is It a Standard Part of Policy?

Most modern malpractice insurance policies now recognize the unique aspects of telemedicine and offer coverage for services provided through this medium. This shift is a response to the increasing reliance on telehealth by healthcare professionals and the recognition of its distinct risk profile.

Coverage typically includes protection against claims arising from remote consultations, diagnosis, and treatment, acknowledging the specific challenges and risks inherent in telemedicine, such as privacy concerns and the limitations of not having physical examinations.

However, it’s important to note that the extent and specifics of coverage can vary significantly between different insurance providers and policies. Some policies might have specific exclusions or conditions related to telemedicine, while others may offer comprehensive coverage.

Healthcare providers are advised to carefully review their malpractice insurance policies to ensure that their telemedicine practices are adequately covered and to consult with insurance professionals for tailored advice. As the field of telemedicine continues to grow and evolve, so too will the insurance products designed to protect those practicing in this innovative healthcare space.

What is the Impact of Telemedicine on Insurance Policies?

The healthcare sector is undergoing a dynamic shift, particularly with the incorporation of telemedicine into standard medical practices. This evolution is not just about adopting new technologies or methods of care; it’s also about understanding and adapting to the changing landscape of risks and the need for appropriate liability coverage.

Integration in Healthcare

Telemedicine, as a mode of healthcare delivery, offers innovative solutions and efficiency in patient care. It allows medical professionals to extend their reach, offering consultations and medical advice through digital means.

If you are planning to start a telemedicine business, the details about insurance are very important. This method of healthcare delivery has gained traction, especially in situations where in-person visits are not feasible or necessary.

However, its integration into the healthcare system is not without challenges. Also, it is important to know that a lot of people are using this option now, which makes it even more important to make it safer, and to implement the risk of potential malpractice as part of standard policies.

According to Harvard Health:

“Almost three-quarters of Americans surveyed said the pandemic has made them more eager to try virtual care. And one in four Americans over age 50 said they’d had a virtual health care visit during the first three months of the pandemic, up from just four percent of older adults who’d had a remote visit the previous year.”

Risks and Challenges

While telemedicine provides numerous benefits, it also introduces a set of unique challenges and potential risks. These include issues related to patient privacy, data security, and the limitations of diagnosing without physical examinations.

Such challenges necessitate a careful examination and potential reevaluation of existing malpractice policies. Traditional policies may not fully encompass the nuances and specific scenarios encountered in telemedicine, leading to potential gaps in coverage.

Reevaluation is Required

The shift towards telemedicine has prompted insurers and healthcare providers to reexamine traditional malpractice insurance policies. It’s essential to ensure that these policies are updated to reflect the new realities of digital healthcare delivery.

This reevaluation is crucial for maintaining comprehensive coverage, addressing the unique liabilities that telemedicine introduces. As healthcare continues to evolve with technological advancements, so must the frameworks that protect the professionals within this field.

Ensuring that malpractice insurance policies keep pace with these changes is vital for the continued growth and sustainability of telemedicine as a key component of modern healthcare.

Cost and Accessibility of Malpractice Insurance

The financial aspects and availability of malpractice insurance in the realm of telemedicine are critical considerations for healthcare providers.

What Can Affect the Price?

Several factors play a pivotal role in determining the cost of malpractice insurance in the telemedicine sector. These include the scope of services provided, the geographical locations covered, the technology used, and the provider’s medical specialty and history.

Additionally, the level of risk associated with different telemedicine practices significantly influences premium rates. Providers offering more complex telehealth services may face higher insurance costs due to the increased risk of potential claims.

Comparison with Traditional Insurance

When comparing traditional malpractice insurance with policies covering telemedicine, there are noticeable differences in pricing structures. Generally, telemedicine policies might have different pricing due to the unique risks and operational models associated with remote healthcare delivery. However, this can vary widely based on the insurer and the specific coverage options chosen by the healthcare provider.

Regional Variations

The availability and accessibility of malpractice insurance for telemedicine can vary significantly across different regions. Some areas may have a wide range of options with competitive pricing, while others might have limited choices, especially in regions where telemedicine is still an emerging practice. Regulatory environments in different states or countries also play a crucial role in the availability of suitable insurance products.

Why Agents are Important?

Insurance brokers and agents are invaluable in navigating the complex landscape of malpractice insurance for telemedicine. They possess the expertise to guide healthcare providers through the nuances of various policies, ensuring that the coverage meets the specific needs of a telemedicine practice. Their role is particularly crucial in identifying policies that offer comprehensive coverage at competitive rates.

- It’s essential to discuss the nature of telehealth services provided, the technology used, and any specific concerns or requirements.

- As telemedicine becomes more mainstream, there may be a trend towards more competitive pricing and broader coverage options.

How to Prove Malpractice?

Proving malpractice in the context of telemedicine involves demonstrating that a healthcare provider failed to meet the standard of care during a remote medical consultation or treatment, leading to harm or injury to the patient. The process is similar to proving malpractice in traditional in-person healthcare settings, but with some unique considerations due to the nature of telemedicine. Here are the key steps:

- Establish a Doctor-Patient Relationship: The first step is to prove that a doctor-patient relationship existed. In telemedicine, this is established when the healthcare provider agrees to diagnose or treat the patient through remote communication technologies.

- Identify the Standard of Care: The standard of care refers to the level and type of care that a reasonably competent healthcare professional, with a similar background and in the same medical community, would have provided under similar circumstances. In telemedicine, this standard can include aspects like ensuring proper technology is used for communication, maintaining patient privacy, and accurately diagnosing or advising based on the information available remotely.

- Demonstrate a Breach of Standard of Care: This involves showing that the healthcare provider failed to meet the established standard of care. In telemedicine, this could be due to misdiagnosis, incorrect advice, technical issues leading to miscommunication, failure to follow up, or not advising an in-person consultation when necessary.

- Link the Breach to Harm: It must be proven that the breach of the standard of care directly caused harm, injury, or worsening of the patient’s condition. This could involve showing how incorrect treatment advice given during a telemedicine consultation led to adverse health outcomes.

- Document Damages: The patient must provide evidence of the damages or harm suffered due to the malpractice. This can include medical records, expert testimony, and documentation of additional medical expenses, lost wages, or pain and suffering resulting from the malpractice.

- Expert Testimony: Often, expert testimony is crucial in telemedicine malpractice cases. An expert in the field can help establish the standard of care, explain how the provider’s actions deviated from this standard, and demonstrate how this deviation caused harm to the patient.

- Consideration of Telemedicine Specifics: Special considerations in telemedicine, such as technology reliability, data security, and the limitations of not being able to conduct a physical examination, are taken into account. The legal framework may also consider the guidelines and regulations specific to telemedicine practices.

FAQs

Can telemedicine malpractice insurance cover cross-state consultations?

Telemedicine malpractice insurance typically covers consultations across state lines, but it’s crucial for healthcare providers to ensure their policy includes multi-state coverage. Different states have varying medical laws and regulations, so professionals should verify that their insurance is valid in the states where their patients are located.

Does telemedicine malpractice insurance cover technical failures during consultations?

Coverage for technical failures during telemedicine consultations depends on the specific policy. Some policies may include provisions for technical issues that lead to misdiagnosis or treatment errors. However, it’s important for providers to clarify this with their insurer, as not all policies automatically cover such incidents.

Are there special malpractice policies for telepsychiatry?

Yes, there are malpractice policies specifically tailored for telepsychiatry. These policies consider the unique aspects of providing mental health services remotely, including privacy concerns and the nuances of diagnosing and treating patients without in-person interaction.

Are there differences in malpractice insurance rates between telemedicine and in-person consultations?

Yes, there can be differences in insurance rates between telemedicine and in-person consultations. Factors such as the perceived risk, the nature of the telemedicine services, and the technology used can influence the cost. Providers often find that telemedicine can be less expensive due to the lower risk of certain types of claims.

Summary

Healthcare providers engaging in telemedicine must be vigilant in ensuring their malpractice insurance covers the specific nature of remote medical services. This includes being aware of the nuances of telemedicine practice, such as cross-state regulations, technical reliability, and the limitations of remote diagnostics.

The role of informed consent and the need for policies tailored to specialties like telepsychiatry are also crucial considerations. Moreover, the evolving legal and regulatory frameworks surrounding telemedicine further underscore the importance of staying informed and seeking expert advice. Insurance brokers and agents who specialize in this field can provide invaluable guidance in selecting the right coverage.